Ask any landlord and they’ll tell you that the key to successful renting is selecting the right tenants. Good tenants can make your life a breeze. They’ll keep the property in good shape, pay on time every month, and keep you informed on maintenance issues. In essence, you can sit back, collect checks, and perform only regular maintenace.

Ask any landlord and they’ll tell you that the key to successful renting is selecting the right tenants. Good tenants can make your life a breeze. They’ll keep the property in good shape, pay on time every month, and keep you informed on maintenance issues. In essence, you can sit back, collect checks, and perform only regular maintenace.

On the flip side, bad tenants are more trouble than they’re worth. A bad tenant can cause so much damage to a property that even if they do pay their rent, you’ll be left in the red. After we decided to start renting out one of our properties, we heard countless horror stories of people who had rental situations go bad. Every time we heard of a story, I asked if the people had performed credit checks on their tenants. Many times the answer was no.

Why Credit Scores Matter

When prospective tenants apply to lease a property, the landlord has very little information to go on: an application, a 15-30 minute conversation, and maybe a background check and income verfication. When you think about the commitment of allowing a person–or family– to rent a property for a year or more, that’s not a whole lot of information on which to base a decision. Credit scores and reports matter because, absent personal experience with a person, it’s one of the few objective measures available to make a wise renting decision. Mortgage companies have known this for years (that’s why everyone thinking about getting a loan should get their FICO credit score and report (for free, no less).

There are other measures, of course. Income verification and obtaining references are two more ways to qualify tenants. Nonetheless, credit scores are indispensable in making leasing decisions… Here’s why…

Leasing Property Is Really About Extending Credit

What most new landlords fail to recognize is that renting property is a lot like extending credit to the renter. Most states have extensive laws that protect tenants from eviction. If a tenant fails to pay you, you can’t simply move their stuff out. Effectively, you become a creditor. You must go to court, get an eviction decree, notify the tenant, schedule the eviction with the City/County, and more. Even if you do manage to make it through the process, it could take 3 months or more to evict a non-paying renter, and that doesn’t account for the time or energy you’ll have to put into the process. Plus, most independent landlords are never able to collect back rent, and instead end up writing off the debt.

Also, credit scores serve as an indicator of overall responsibility. It make sense of course: if a person is responsible with their finances, they are likely to be responsible in other areas. Don’t believe me? That link from About.com talks about how car insurance companies have come under fire for using credit scores to determine insurance rates, because they have found a meaningful correlation between credit scores and responsibility.

And finally… a person with a good credit score usually wants to maintain it. A person with a bad credit score has nothing to lose. When it comes time to decide whether to walk away from a lease or struggle to make the payments on time, you want a person who is defending their score.

What Credit Score Should be Required for Renting?

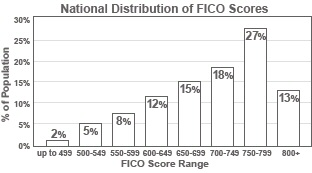

Before answering that question, let’s start with the overall distribution of credit scores (as reported by Fair Isaac):

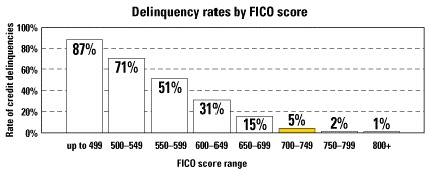

Notice that 58% of the population have a score over 700, while a mere 15% have a score below 600. That’s an interesting data point, but it doesn’t do a whole lot to help us predict the persons liklihood to pay rent on time. Fortunately, Transunion publishes delinquency rates by credit score as part of their credit reporting example:

This chart shows the number percent of people who are likely to be more than 90 days late on a payment in the next 24 months. Pretty amazing huh? A person whose credit score is beteen 550-599 is more than 50% likely to have a 90 day delinquency on payments, while a person whose score is over 700 has a 95% liklihood of no 90-day delinquencies.

So, what’s the right minimum credit score to require? This is a judgment every landlord has to make for themselves. Our recommendation: 685-700, which gives the landlord a better than 90% probability that the rent will be paid with no 90 day delinquencies, and provides a large pool of qualified applicants (remember, about 60% of all people have a score of 685 or better).

If your applicant doesn’t meet that bar, ask them to find a co-signer who does. If they can’t find someone, decline their application. Remember, the most successful rental situations are about the long term. It just doesn’t make sense to risk a poor rental situation to get the place filled.

What About Someone with No Credit History?

It is not uncommon for renters to lack a credit history altogether, especially since much of the renting population is young.

Our recommendation: get a co-signer on the lease who meets the credit requirements.

You can Check Credit Scores Online

All you need to check someone’s credit for a rental property is a copy of the rental property application, the applicant’s vital info (Name, SSN, Address, etc.), and a credit check release authorization. In most cases, this process can be performed online. We’ve used Accurate Credit Bureau to do several checks and were pleased with the results. Here’s their landlord services landing page.

Prospective Tenants: Get Your Score

The credit bureaus will provide you a free copy of your credit score, at absolutely no charge, once per year, at annualcreditreport.com.

What do you think? What credit requirements do you require for your rental property?

photo: turkeychik.

All of which is fine and dandy, save for the fact that the credit reporting/recording/scoring industry is so full of incompetence and inaccuracy that they can’t be trusted any farther than you can see them.

As it is, most mortals cannot speak to living beings at any of the credit bureaus and reporting houses. Mistakes are allowed to perpetuate. Accounts are married and inaccuracies are the norm.

As it is, there are secret files that you as a consumer are not shown. You are not compensated for any trouble that they cause you.

When the day comes that all credit bureaus and the FICO cartel are made to follow the same laws as the rest of us I will put more credence into a credit score.